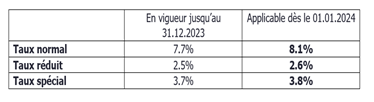

1. New VAT Rules for 2024

From January 1, 2024, VAT rates will be increased:

This also applies to net tax debt rates. For details, click on the link below:

Taux de la dette fiscale nette à partir du 1er janvier 2024 | AFC (admin.ch)

In practical terms, this means that all services (not invoice dates) provided up to December 31, 2023 will be subject to the current rates, while all services provided from January 1, 2024 will have to be invoiced at the new VAT rates.

An invoice issued in 2023 for services to be carried out in 2024 will have to mention the new VAT rate (example: maintenance contract).

In the last quarter of 2023, you'll need to pay close attention to the rate to be applied.

In principle, your next VAT statements should mention the 2 types of rate. Should this not be the case, please do not hesitate to contact us.

If you have any questions, please do not hesitate to contact us.

[email protected]

Taux de la dette fiscale nette à partir du 1er janvier 2024 | AFC (admin.ch)

In practical terms, this means that all services (not invoice dates) provided up to December 31, 2023 will be subject to the current rates, while all services provided from January 1, 2024 will have to be invoiced at the new VAT rates.

An invoice issued in 2023 for services to be carried out in 2024 will have to mention the new VAT rate (example: maintenance contract).

In the last quarter of 2023, you'll need to pay close attention to the rate to be applied.

In principle, your next VAT statements should mention the 2 types of rate. Should this not be the case, please do not hesitate to contact us.

If you have any questions, please do not hesitate to contact us.

[email protected]

2. Tax threshold for associations from 2023

3. New VAT Rules for 2020

From January 2020, your VAT returns will have to be submitted via an online form.

For more information, please contact our secretary’s office on 027 455 60 83 or [email protected].

4. Main New VAT Rules for 2018

A)

|

From now on, your worldwide turnover will form the basis for determining your liability

Examples Before 2018: Turnover (subject to VAT) generated in Swiss territory: Fr. 80,000.00 Turnover (subject to VAT) generated in foreign territory: Fr. 30,000.00 No liability As from 2018: Turnover (subject to VAT) generated in Swiss territory: Fr. 80,000.00 Turnover (subject to VAT) generated in foreign territory: Fr. 30,000.00 Liability |

|

B)

|

Fiscal representation in Switzerland with respect to VAT

Under certain conditions, as from 1st January 2018, you will be liable for VAT in Switzerland as from the very first franc if you generate a worldwide turnover of at least CHF 100,000 through taxable benefits. At that point, the appointment of a tax representative in Switzerland will be compulsory for foreign businesses. To this end, we offer you the following VAT-related services:

|

We would be happy to provide you with advice on any administrative and accounting matters.